Business Insurance in and around Columbus

Searching for protection for your business? Search no further than State Farm agent Kevin Buffington!

Helping insure businesses can be the neighborly thing to do

- State of Georgia

- State of Alabama

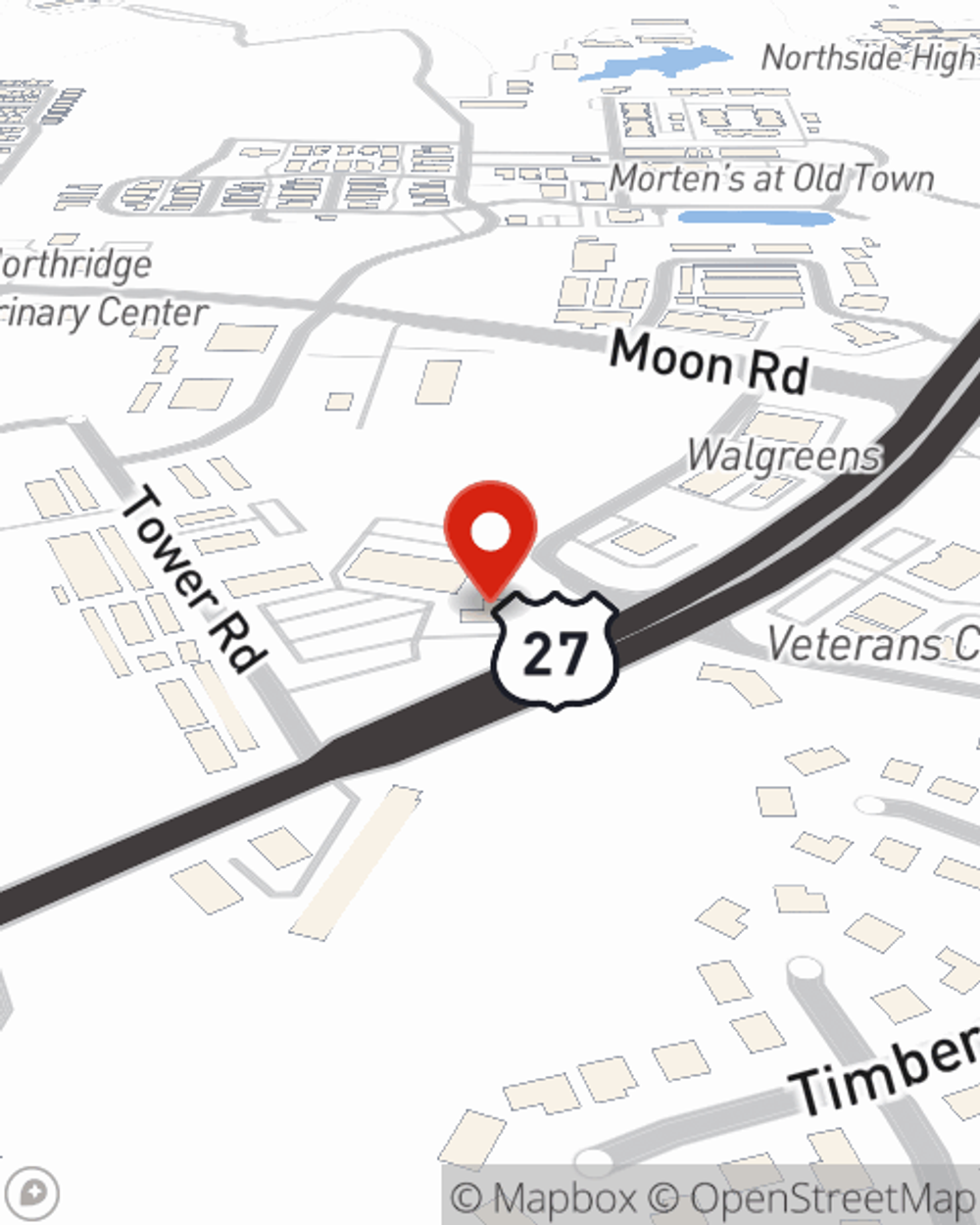

- Columbus

- Phenix City

- Harris County

- Lake Harding

- Lake Oliver

- Callaway Gardens

- Smith Station

- Midland

- Pine Mountain

- Hamilton

- Auburn

- Opelika

- Ellerslie

- Forsyth

- Seale

- Fort Mitchell

- Fort Moore

- Alpharetta

- Upatoi

- Buena Vista

- Lawrenceville

- Cataula

Your Search For Remarkable Small Business Insurance Ends Now.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Kevin Buffington help you learn about great business insurance.

Searching for protection for your business? Search no further than State Farm agent Kevin Buffington!

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

If you're looking for a business policy that can help cover buildings you own, business liability, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

At State Farm agent Kevin Buffington's office, it's our business to help insure yours. Contact our excellent team to get started today!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Kevin Buffington

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.